Learn all about income tax refunds: calculations, complex cases, delays, tax credits, and rights. A beginner’s guide with tips to maximize your refund!

Table of Contents

Introduction to Income Tax Refunds

Let’s imagine that after settling your bills, you find a check from the government with money you didn’t know was coming. It’s a dream come true, isn’t it? Income tax season can make people feel the same way a refund does. If you’re given a tax refund, it means you paid more tax than you were required to. This might occur if more tax was deducted from your paycheck than needed or if you’ve prepaid your taxes. For most people, receiving a refund is great, but it’s important to understand the process so you can make good use of it.

This guide will help you understand income tax refunds in easy language. Even if you’ve never faced taxes or are self-employed, you will know how tax refunds are decided and what you should and shouldn’t do. Let’s get started!

How Are Income Tax Refunds Calculated?

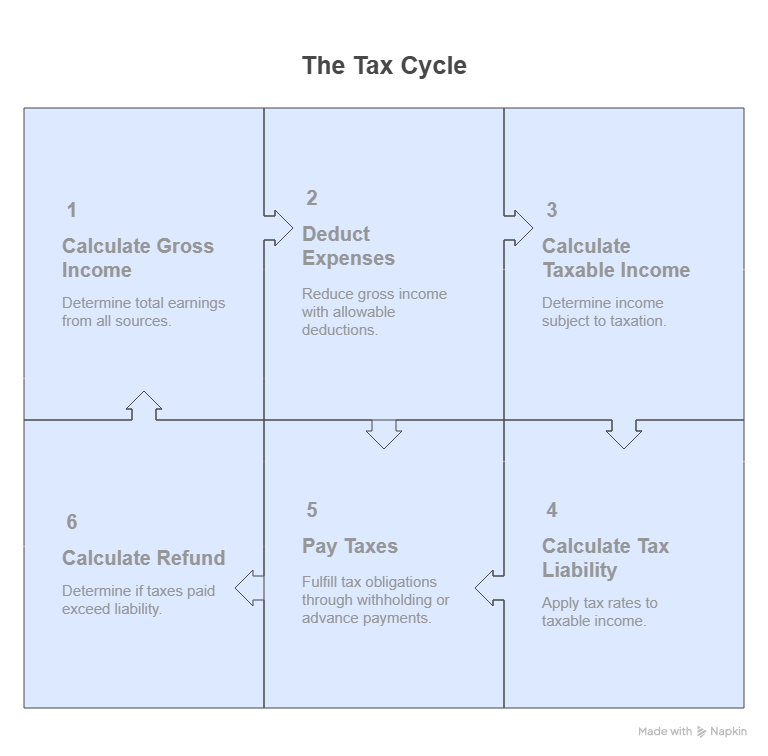

Think of taxes like a grocery bill: you pay an estimated amount throughout the year, but at tax time, the government calculates what you actually owe. If you paid more than needed, you get a refund. Here’s how it works:

- Your Income: Your total earnings (salary, freelance income, investments, etc.) are your gross income. Certain deductions (like retirement contributions) reduce this to your taxable income.

- Tax Owed: The government applies tax rates to your taxable income to determine your tax liability (what you owe).

- Taxes Paid: Throughout the year, taxes are withheld from your paycheck (via TDS or Tax Deducted at Source) or paid as advance tax if you’re self-employed.

- Refund Calculation: If your taxes paid exceed your tax liability, the difference is your refund.

Example for a Salaried Employee:

Suppose Priya earns ₹9,00,000 annually. Her employer withholds ₹50,000 in TDS. Based on the tax slabs under new tax regime, her tax liability is ₹ 0. Since she paid ₹50,000, her refund is ₹50,000 – ₹ 0 = ₹50,000. That means excess tax paid to government is refunded.

Complex Refund Scenarios Made Simple

Tax refunds aren’t always straightforward, especially for unique situations. Let’s break down some complex cases:

- Non-Resident Indians (NRIs): If you’re an NRI, your income earned abroad may be taxed differently due to Double Taxation Avoidance Agreements (DTAAs). For example, if you’re taxed in both India and the US, you can claim a refund for excess taxes paid in India by submitting Form 67 and DTAA details with your ITR.

- Reassessments: If the tax department reassesses your return (e.g., due to a mismatch), you may owe more or get a refund. For instance, if an error reduced your deductions, a reassessment could increase your refund.

- International Income: If you earn income abroad (e.g., from freelance clients in the US), you may face TDS in India. Claiming a refund requires reporting this income correctly and applying tax treaty benefits.

What to Do If Your Refund Is Delayed or Denied

Waiting for a refund can be frustrating, especially if it’s delayed or denied. Here’s what to do:

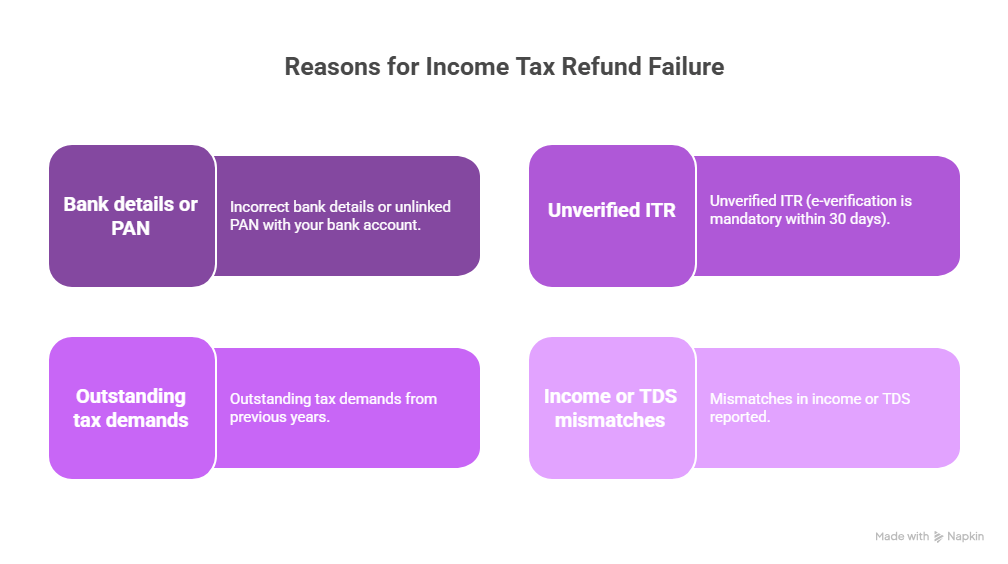

- Common Reasons for Delays or Denials:

- Incorrect bank details or unlinked PAN with your bank account.

- Unverified ITR (e-verification is mandatory within 30 days).

- Outstanding tax demands from previous years.

- Mismatches in income or TDS reported in your ITR vs. Form 26AS.

- Steps to Resolve:

- Check Status: Log into the e-filing portal (incometax.gov.in) with your PAN and assessment year to track your refund.

- File a Rectification Request: If there’s a mismatch (e.g., TDS not reflected), file a rectification request on the portal under “e-File > Rectification.”

- Appeal a Denial: If your refund is rejected, file an appeal with the Commissioner of Income Tax (Appeals) within 30 days using Form 35.

The Emotional and Financial Side of Waiting for a Refund

Waiting for a refund can feel like waiting for a delayed flight—stressful and uncertain. For low-income families, a refund might mean paying off debts or covering essentials. Here’s how to cope:

- Financial Planning: Don’t rely on refunds for major expenses. Budget as if the refund isn’t coming.

- Managing Stress: Track your refund status regularly to stay informed. If delayed, contact the CPC promptly.

- Story: Sarah, a single mother, expected a ₹20,000 refund to cover school fees. When it was delayed due to an unverified ITR, she felt overwhelmed. By e-verifying her return and contacting the CPC, she received her refund in 3 weeks, easing her stress.

Frequently Asked Questions (FAQs)

When am I eligible for an income tax refund?

Your income tax refund is the difference between the taxes you paid during the year and the taxes you actually owe. If this is the case, then yes, you are eligible for income tax refunds.

What should I do if my refund is delayed or denied?

Delays or denials often happen due to incorrect bank details, unverified ITRs, mismatches in income reported, or outstanding tax demands. First, check your refund status on the e-filing portal (incometax.gov.in) using your PAN and assessment year. Ensure your ITR is e-verified within 30 days of filing. If there’s a mismatch (e.g., TDS not matching Form 26AS), file a rectification request under “e-File > Rectification” on the portal. If your refund is denied, you can appeal within 30 days of the order using Form 35 with the Commissioner of Income Tax (Appeals).

Can I get a refund if I’m a non-resident Indian (NRI)?

Yes, NRIs can claim refunds if they’ve overpaid taxes in India, but it’s a bit more complex due to Double Taxation Avoidance Agreements (DTAAs).

What are my rights if my refund is delayed or adjusted?

As a taxpayer, you have rights to ensure fair treatment. If your refund is delayed, you’re entitled for interest under Section 244A of the Income Tax Act.

Conclusion: Taking Control of Your Tax Refund

Income tax refunds are like a financial bonus, but understanding the process empowers you to claim what’s yours efficiently. From calculating your refund to resolving delays and planning for future tax years, you now have the tools to navigate this process confidently. Start by checking your refund status today on the official income tax webpage, and consider consulting a tax professional for complex cases. Your refund is your money—make it count!

Like reading our articles, visit our dedicated Income Tax section for more articles.