Master Income Tax for 2025! Explore slabs, deductions, ITR filing, freelancer tips, and FAQs. Simple Income Tax guide for beginners. Start your journey now!

Table of Contents

The experience of assisting my Mumbai friend with his Income Tax notice remains etched in my memory because it was complete disorder. The process revealed that Indian Income Tax operates beyond being mere forms as it serves as a required skill for all individuals. Every financial aspect of residents in Mumbai and salaried workers or freelancers from Delhi alongside students in Bangalore and retirees in Chennai comes under the influence of Income Tax. This article tries to explains primary Income Tax principles including income scales and reporting regulations as well as deductions in addition to recent changes and practical suggestions. Do you wonder how Income Tax affects your freelance work and savings? Let’s crack Indian Income Tax, no fuss!

1. Why Income Tax Matters to All

According to the Income Tax Act of 1961, the revenue collected from taxing individual earnings supports the construction of schools and development of roads besides guiding financial investments. Revenue from Indian Income Tax reaches every segment of society including tech professionals, commercial representatives, retirees and students doing additional work.

2. Income Tax Slabs and Regimes: Your Rate

Income Tax slabs decide your tax, and regimes offer options. Here’s the 2025-2026 Income Tax setup:

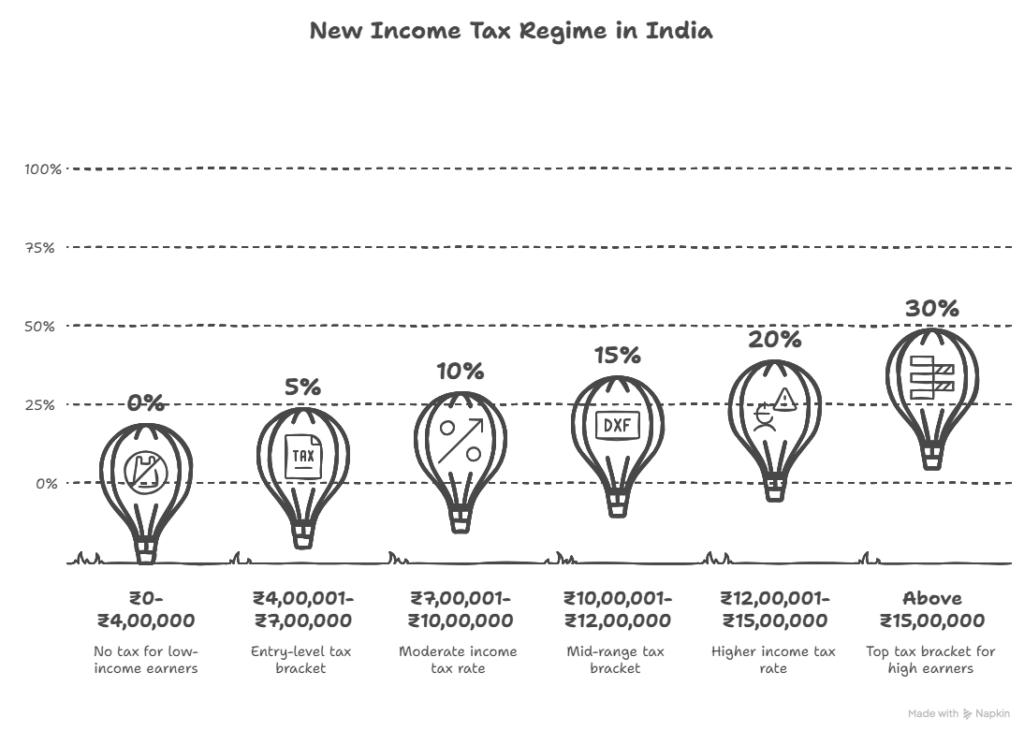

New Income Tax Regime

- ₹0-₹4,00,000: 0%

- ₹4,00,001-₹7,00,000: 5%

- ₹7,00,001-₹10,00,000: ₹15,000 + 10%

- ₹10,00,001-₹12,00,000: ₹45,000 + 15%

- ₹12,00,001-₹15,00,000: ₹75,000 + 20%

- Above ₹15,00,000: ₹1,35,000 + 30%

- Section 87A: No Income Tax below ₹12 lakh (for regular income excluding specially taxed income e.g. stock market income, etc.)

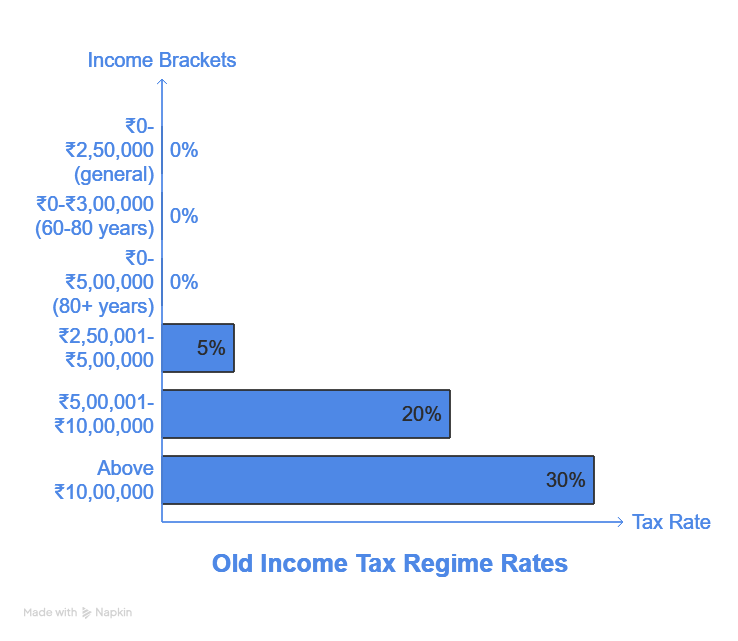

Old Income Tax Regime

- ₹0-₹2,50,000 (general): 0%

- ₹0-₹3,00,000 (60-80 years): 0%

- ₹0-₹5,00,000 (80+ years): 0%

- ₹2,50,001-₹5,00,000: 5%

- ₹5,00,001-₹10,00,000: ₹12,500 + 20%

- Above ₹10,00,000: ₹1,12,500 + 30%

Example: ₹6 lakh in old regime pays ₹33,800 Income Tax (including cess). Under new regime, tax will be zero in this case as Income does not exceed 12 lakh limit and rebate can be availed!

3. Types of Income: What’s Taxed

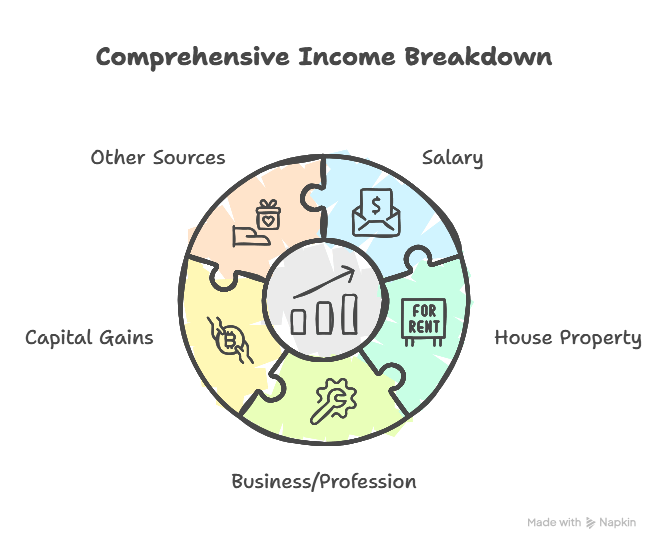

Income Tax hits five income types:

- Salary: Pay, bonuses, HRA (partly exempt under old regime).

- House Property: Rent, minus 30% deduction.

- Business/Profession: Shop, professional, freelancer, etc.

- Capital Gains: Stock Market, property, crypto sales, etc.

- Other Sources: Interest, dividend, gifts over ₹50,000, etc.

4. Income Tax Deductions: Save Big

Income Tax deductions cut your taxable share under Old Regime. Some generally available deductions are:

- Section 80C: ₹1,50,000 for PPF, ELSS, insurance, housing loans, etc.

- Section 80D: ₹25,000 health insurance; ₹50,000 for seniors.

- HRA: Exempt by salary, rent, city (50% metros).

- Section 80TTA: ₹10,000 savings interest (non-seniors).

- Section 80TTB: ₹50,000 deposit interest (senior citizens).

- Section 80U: ₹75,000-₹1,25,000 for disability.

- File proofs of investments and expenses for Income Tax relief with your employer. New regime skips most but keeps standard cuts. Plan Income Tax savings!

5. Real-Life Income Tax Scenarios

Income Tax clicks in stories:

- Priya, Freelancer Interior Designer: ₹8 lakh from Delhi work. Section 44ADA taxes total income @ ₹4 lakh—₹12,500 Income Tax (new regime). No tax liability as total income is below 12 lakhs.

- Raj, Salaried: ₹10 lakh salary, ₹2 lakh Mumbai rent. Income Tax: ₹65,900. Files ITR-2.

6. 2025 Income Tax Updates

Income tax regulations in India have seen some significant changes in 2025 aimed at increasing transparency, simplifying compliance, and offering more relief to taxpayers. Here’s a detailed look at what’s evolved in the current financial year:

Budget: ₹4 lakh exemption, ₹12 lakh rebate

The Union Budget 2025 has brought in major changes to income tax slabs and relief measures:

- Basic Exemption Limit Increased to ₹4 Lakh:

The government has raised the basic exemption limit from ₹2.5 lakh to ₹4 lakh, offering much-needed relief to low and middle-income taxpayers. This move is expected to benefit a large section of salaried individuals and pensioners. - Rebate Under Section 87A Increased to ₹12 Lakh:

Taxpayers with income up to ₹12 lakh (under the new tax regime) can now claim a full rebate under Section 87A. This essentially means that individuals earning ₹12 lakh or less will have zero tax liability, if they opt for the new regime.

Income Tax Bill: 536 sections simplify TDS, filing

The government has introduced a new Income Tax Bill replacing the decades-old legislation. Key highlights include:

- Streamlined Provisions – Only 536 Sections:

The new bill simplifies the complex framework by consolidating and rewriting tax laws. The revised code now has 536 clear and concise sections, aimed at reducing ambiguity and litigation. - Simplification of TDS/TCS Rules:

The provisions related to Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) have been revamped. Categories have been rationalized, and rates standardized for better compliance. - Ease of Filing and Dispute Resolution:

The bill introduces pre-filled returns, AI-assisted tax summaries, and fast-track faceless assessments, making tax filing more intuitive and less error-prone.

7. Filing Your Income Tax Return

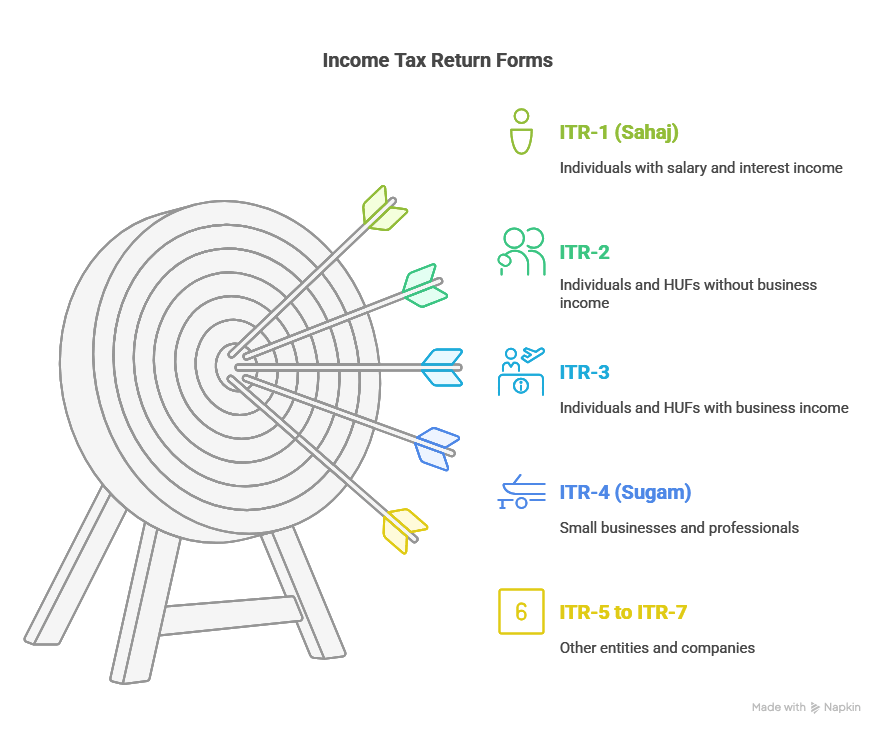

Filing of Income Tax Returns (ITR) is mandatory for individuals whose income exceeds the basic exemption limit based on new and old regime selection. The various ITR forms are:

- ITR-1 (Sahaj) – For individuals being a resident (other than not ordinarily resident) having total income upto Rs.50 lakh, having Income from Salaries, one house property, other sources (Interest etc.), and agricultural income upto Rs.5 thousand.

- ITR-2 – For Individuals and HUFs not having income from profits and gains of business or profession.

- ITR-3 – For individuals and HUFs having income from profits and gains of business or profession.

- ITR-4 (Sugam) – For Individuals, HUFs and Firms (other than LLP) being a resident having total income upto Rs.50 lakh and having income from business and profession which is computed under sections 44AD, 44ADA or 44AE and agricultural income upto Rs.5 thousand.

- ITR-5 – For persons other than- (i) individual, (ii) HUF, (iii) company and (iv) person filing Form ITR-7

- ITR-6 – For Companies other than companies claiming exemption under section 11

- ITR-7 – For persons including companies required to furnish return under sections 139(4A) or 139(4B) or 139(4C) or 139(4D) only

- The deadline for filing ITR is July 31 for individuals and October 31 for businesses requiring audits.

8. Income Tax for Freelancers

Income Tax for non-salaried:

- Presumptive: ₹10 lakh? Calculate Tax only on ₹5 lakh (Section 44ADA for select professionals without maintenance of books of accounts).

- Advance Income Tax: Over ₹10,000? Pay tax in installments, or face interest.

9. Income Tax for Seniors, NRIs

Income Tax adjusts for some:

Seniors Citizens

Senior citizens, particularly those aged 60 and above, continue to receive preferential treatment under the Income Tax Act, with some improvements in 2025:

- Higher Basic Exemption Limit:

The basic exemption limit for resident senior citizens (aged 60–79 years) has been retained at ₹5 lakh. For super senior citizens (aged 80+), it is now ₹7 lakh, as per the latest announcements. - No Advance Tax Liability for Pension + Interest Income:

Senior citizens having only pension and interest income are exempt from paying advance tax, thereby reducing their compliance burden. - Easier Filing:

The new income tax portal includes simplified ITR forms (ITR-1 ) for senior citizens with fewer income heads and pre-filled data. - Reduced TDS on Interest Income:

Under Section 194A, senior citizens can now submit Form 15H more conveniently to avoid TDS on bank FD interest income up to ₹50,000.

NRIs

- Relief from Double Taxation:

The new Income Tax Bill enhances India’s commitment to its Double Taxation Avoidance Agreements (DTAA), providing clearer provisions for foreign tax credits and relief mechanisms. - Updated Residential Status Rules:

The threshold for being classified as a “resident but not ordinarily resident (RNOR)” has been clarified, especially for Indian citizens visiting India frequently due to remote work or business. - Investment Income Clarity:

More transparent rules on capital gains taxation for NRIs investing in Indian equity markets and real estate, including a lower TDS rate for LTCG under certain treaties. - Streamlined NRO Account TDS Compliance:

TDS processes for interest income in NRO accounts are now better integrated with the Income Tax portal, reducing the chances of mismatch or delays in claiming refunds.

Differently-Abled

Taxpayers with disabilities (either physical or mental) are eligible for deductions under Section 80U. In 2025, these have been re-affirmed and clarified:

- Standard Deduction Amounts (Unchanged):

- ₹75,000 for individuals with 40% to 79% disability

- ₹1,25,000 for individuals with 80% or more (severe) disability

- No Medical Bills Required:

Unlike Section 80DDB (which requires medical bills for specific diseases), 80U only needs a valid disability certificate from a medical authority, making the claim process simpler. - Allowed Over & Above Regular Deductions:

Section 80U benefits can be claimed in addition to deductions under Sections 80C, 80D, etc., offering more comprehensive tax relief to eligible individuals. - Caregivers Support (Section 80DD):

Family members supporting a dependent with a disability can also claim deductions under Section 80DD, which has similar deduction limits.

10. Tech for Income Tax Ease

Income Tax loves tech:

Portal: AIS downloads

The official Income Tax portal is more powerful and user-friendly than ever:

- AIS (Annual Information Statement) Downloads:

Taxpayers can now easily access and download their Annual Information Statement (AIS), which consolidates key financial information like TDS, SFT transactions, interest income, stock trades, and foreign remittances. - E-Verify Returns with Ease:

Income Tax Returns (ITRs) can be e-verified instantly using Aadhaar OTP, net banking, Demat account, or even via Digital Signature (DSC). No need to send physical ITR-V anymore for most taxpayers. - Pre-filled ITRs:

Salary, TDS, interest income, and capital gains are pre-filled in ITR forms, reducing manual entry and errors.

Calculators: incometaxindia.gov.in for estimates

The Central Board of Direct Taxes (CBDT) offers a range of easy-to-use tax calculator on the official website:

11. Income Tax-Smart Habits

Income Tax lasts a lifetime:

- Updates: Follow CBDT for Income Tax news.

- Planning: PPF, NPS cut Income Tax, grow wealth.

- Records: Save Form 16, receipts.

Build Income Tax smarts. Get our eBook, “Income Tax Planning for Your 20s.” Join #TaxSmart—your 2025 Income Tax goal?

12. Income Tax FAQs: Your Questions Answered

Got Income Tax questions? Here are answers to common beginner queries:

What’s the difference between old and new Income Tax regimes?

The old Income Tax regime offers deductions like 80C but higher rates; new skips most deductions for lower rates and a ₹4 lakh exemption in 2025. Choose based on savings—new suits low investors, old for heavy savers. Check our slab table!

Do freelancers pay different Income Tax?

Yes, freelancers can use Section 44ADA for presumptive Income Tax, taxing 50% of earnings. Advance Income Tax applies if liability exceeds ₹10,000. Quarterly payments keep you penalty-free. See our freelancer section!

When must I file my Income Tax Return?

File your Income Tax Return by July 31 for individuals. Late filing triggers a ₹5,000 fee under Section 234F. Early filing avoids stress—start with Form 26AS to verify income. Watch our e-filing video!

Can I reduce Income Tax without deductions?

In the new Income Tax regime, you get a ₹50,000 standard deduction and ₹4 lakh exemption. Beyond that, plan incomes like rent or gains to stay low. Our deduction checklist helps maximize savings!

What if I get an Income Tax notice?

Don’t panic—an Income Tax notice often seeks clarification. Log into the portal, respond within 30 days, and check Form 26AS for errors. Consult a CA if stuck. Our filing section has more tips!

Income Tax slabs, deductions, ITRs, FAQs—you’re set to conquer Indian Income Tax. It’s not scary—it’s power. Check Form 26AS, file right, save smart. Next, we’ll dive into Income Tax deductions—stay tuned! Subscribe for Income Tax tips. Want investments, notices? Comment! Share with an Income Tax newbie. #TaxSmart

Interested in learning more about Income Tax? Explore our dedicated Income Tax section here.