Learn about BBMP Property Tax, including online payment steps, tax calculation, rebates, due dates, and penalties. Stay updated with the latest rules and ensure timely tax compliance in Bengaluru.

Local governments depend on property taxes to collect funding, which they use for infrastructure development and essential service maintenance. BBMP functions as the local government body that conducts property tax assessments and tax collection activities in Bengaluru. A complete guideline explores BBMP property tax features so property owners understand their duties and tax procedures.

Table of Contents

1. Introduction to BBMP Property Tax

Property owners in BBMP jurisdiction must pay this yearly tax known as BBMP property tax. The tax revenue supports public infrastructure including road systems and park services and drainage networks to maintain Bengaluru’s operational capacity. Responsible payment of property taxes serves both municipal obligations and city development projects in Bengaluru.

2. Tax Period and Due Dates

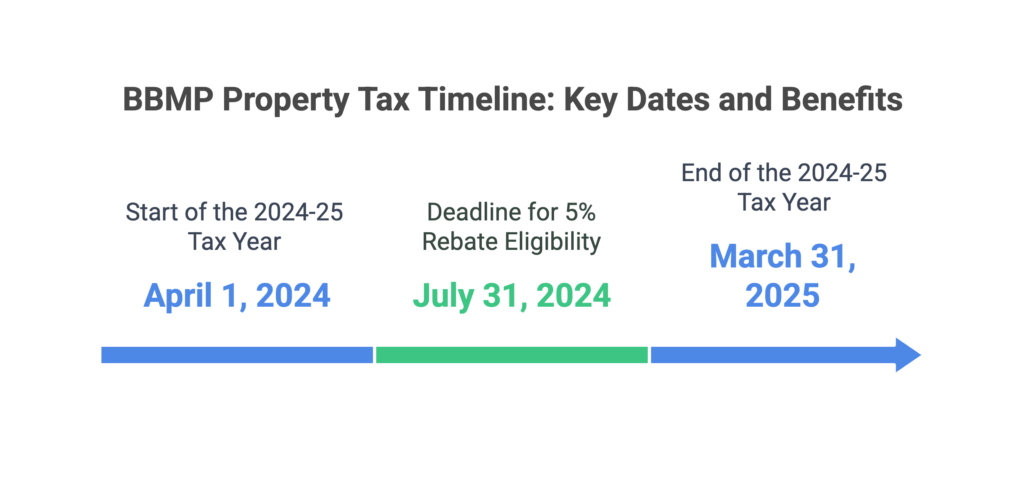

The BBMP property tax operates annually and spans from April 1st until March 31st of the upcoming year. For instance, the tax period for the financial year 2024-25 spans from April 1, 2024, to March 31, 2025.

The BBMP sets specific payment deadlines where all property taxpayers must complete their payments. Property owners who make complete tax payments to BBMP before July 31st of the assessment year will receive a 5% rebate.

The benefit from this rebate requires property tax payments in full by the July 31st deadline of 2024 for the 2024-25 assessment year.

3. Calculation Methodology: Unit Area Value (UAV) System

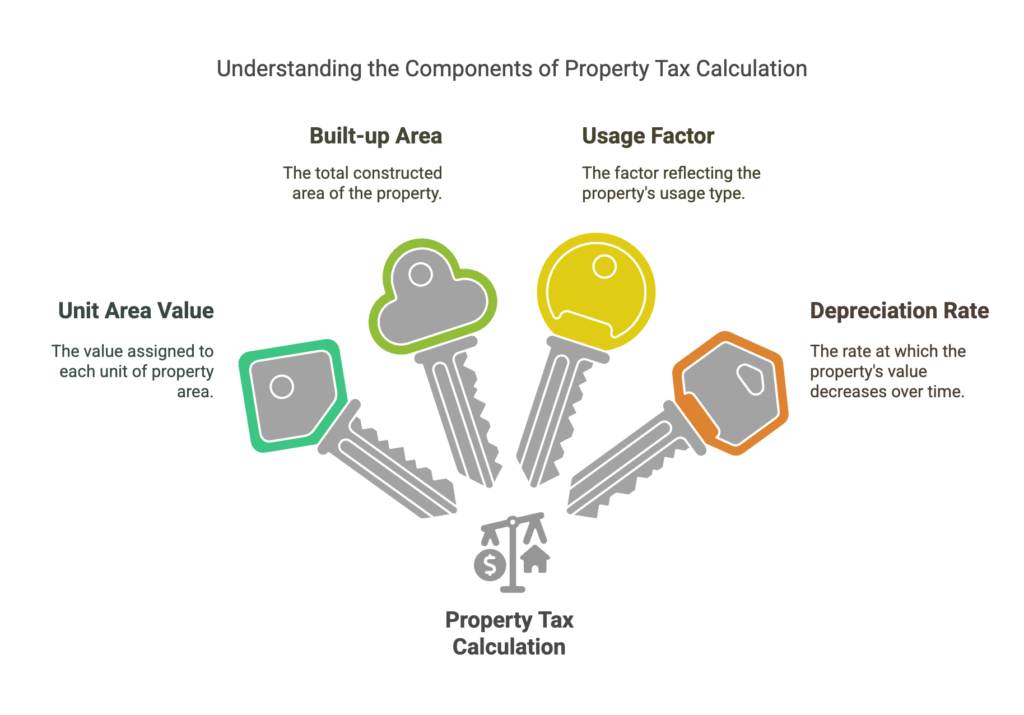

The BBMP calculates property tax through its Unit Area Value (UAV) system. The assessment process considers three key factors about the property, i.e. location, usage and anticipated returns.

Bengaluru operates through six value zones, where each area has its own established calculation rate for square-foot properties based on projected returns. The standard formula to determine annual property tax assesses

Property Tax = (Unit Area Value) x (Built-up Area) x (Usage Factor) x (Depreciation Rate)

Where:

- Unit Area Value: The per-square-foot rate assigned to the property’s location.

- Built-up Area: The total constructed area of the property.

- Usage Factor: A multiplier based on the property’s purpose (residential, commercial, etc.).

- Depreciation Rate: A percentage reduction based on the property’s age.

4. Steps to Pay BBMP Property Tax Online

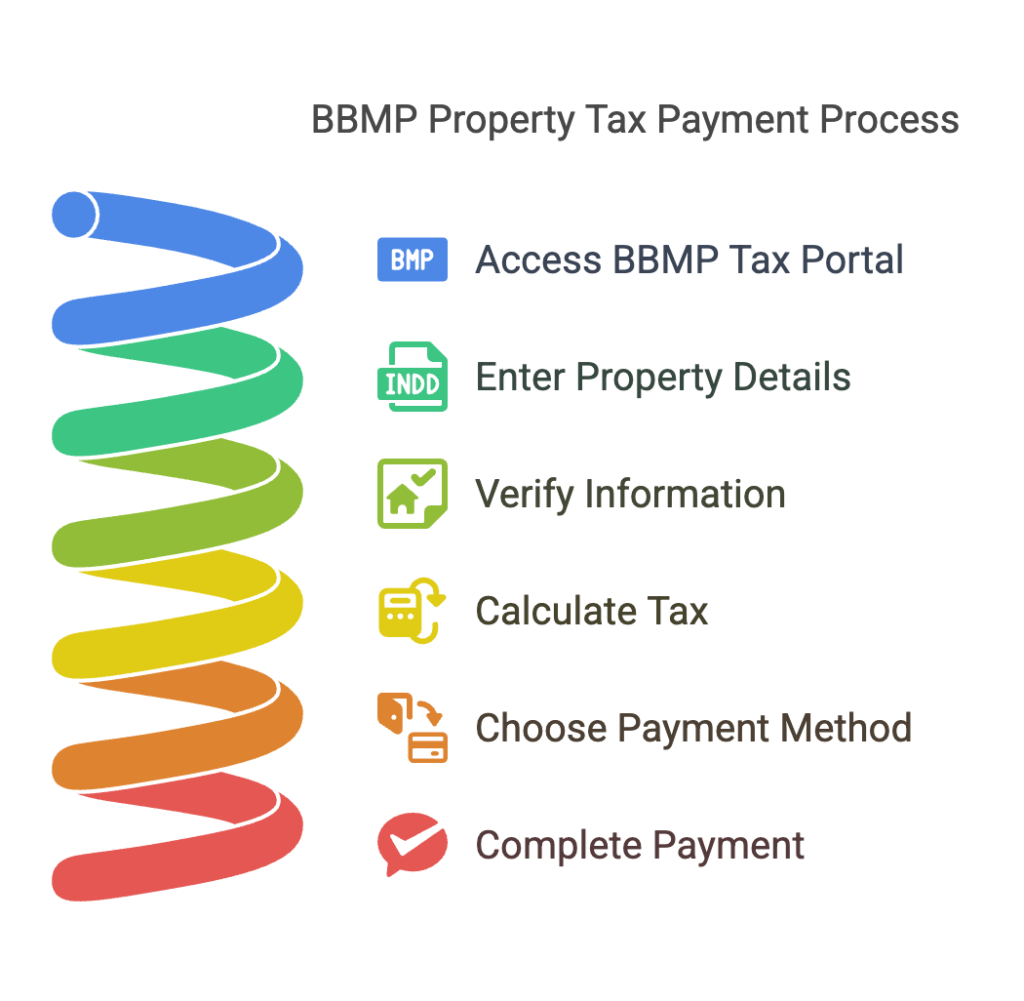

The BBMP has streamlined the property tax payment process through its online portal, enhancing convenience for property owners. The steps are as follows:

- Access the BBMP Tax Portal: Visit the official BBMP property tax website.

- Enter Property Details: To retrieve existing property details, input your previous application number or Property Identification Number (PID).

- Verify Information: Ensure all fetched details are accurate. If there have been changes (e.g., property usage, dimensions), update them accordingly.

- Calculate Tax: The system will auto-calculate the payable tax based on the provided information.

- Choose Payment Method: Select from available online payment options, such as net banking, debit/credit cards, or UPI.

- Complete Payment: After successful payment, generate and save the e-receipt for your records.

5. Offline Payment Options

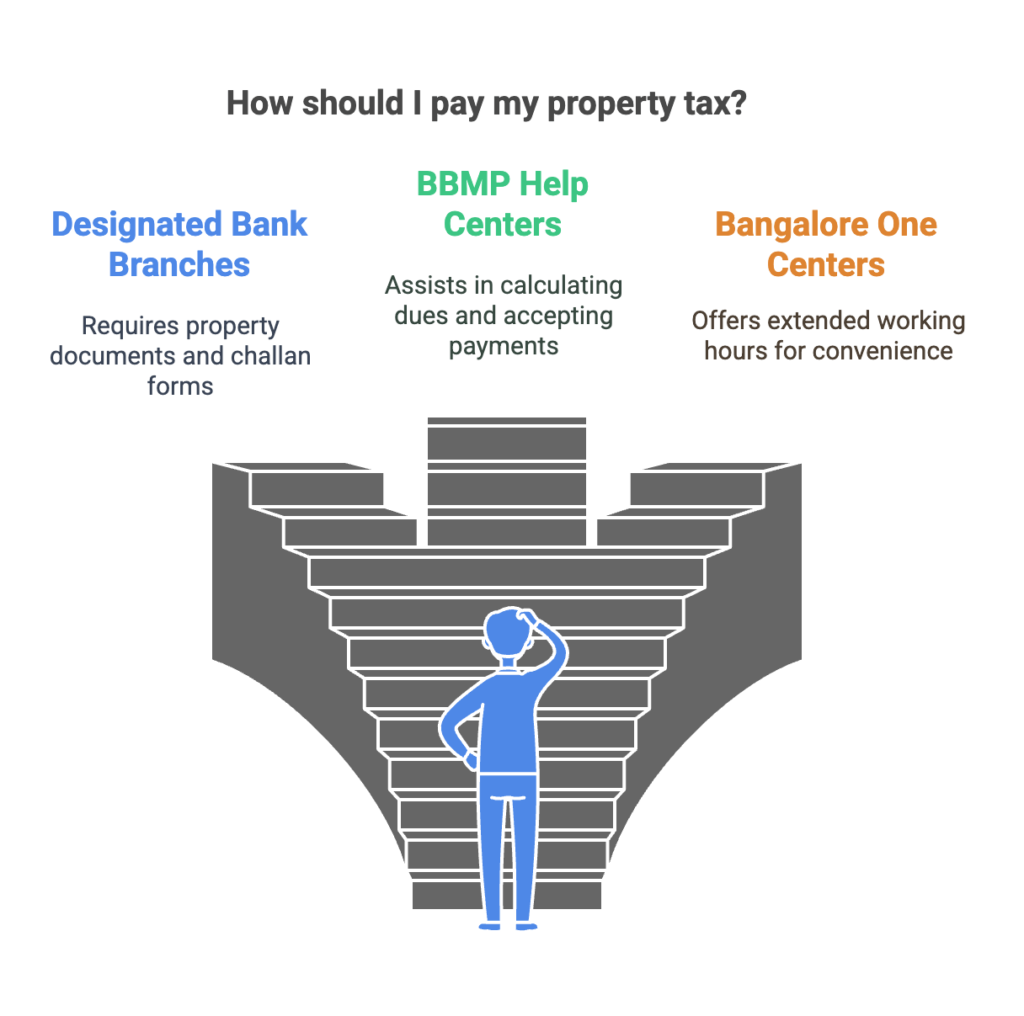

For those who prefer offline methods, BBMP facilitates offline tax payments:

- Designated Bank Branches: Property tax can be paid at specific bank branches authorized by the BBMP. It’s advisable to carry the necessary property documents and filled challan forms.

- BBMP Help Centers: These centers assist taxpayers in calculating dues and accepting payments.

- Bangalore One Centers: These multi-service centers also accept property tax payments and offer extended working hours for added convenience.

6. Understanding Khata: A and B Khata Properties

‘Khata’ refers to an account maintained by the BBMP that documents property details for tax purposes. There are two primary classifications:

- A Khata: This category includes properties that fulfill all applicable building regulations and hold official approvals. These properties acquire legal status, which enables them to qualify for loans and receive trade licenses, as well as various official support and recognition.

- B Khata: Properties that violate building bylaws or lack proper sanctions are listed under B Khata. While these properties can still have taxes paid against them, they are deemed unauthorized. Owners may face restrictions in obtaining loans or licenses until the property is regularized.

7. Penalties for Late Payment

Property tax payments should be made on time. Property owners face penalties of 2% of late payments for each month that property taxes remain unpaid. A persistent tax default will subject property owners to legal enforcement and property confiscation from the BBMP.

8. Exemptions and Concessions

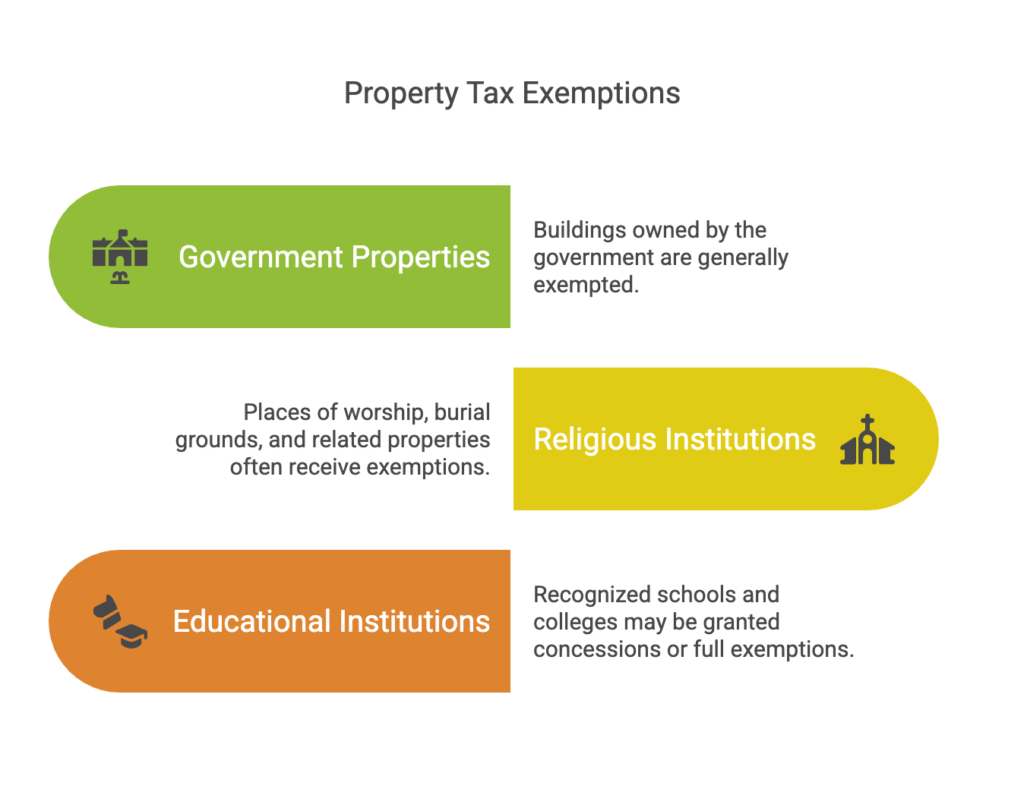

Specific properties may qualify for tax exemptions or concessions:

- Government Properties: Buildings owned by the government are generally exempted.

- Religious Institutions: Places of worship, burial grounds, and related properties often receive exemptions.

- Educational Institutions: Recognized schools and colleges may be granted concessions or full exemptions.

Property owners should consult the BBMP or refer to official guidelines to determine eligibility for exemptions.

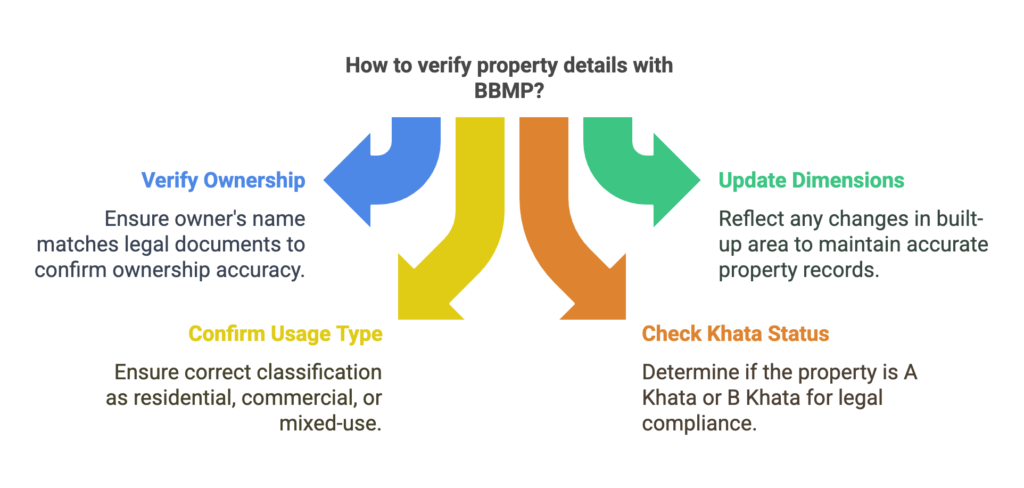

9. Importance of Accurate Property Details

Ensuring accurate property details in BBMP records is crucial for avoiding legal issues and penalties. Property owners should verify the following:

- Ownership details: Ensure that the owner’s name matches legal documents.

- Property dimensions: Any changes in the built-up area should be updated with BBMP.

- Usage type: Residential, commercial, or mixed-use classification should be correct.

- Khata status: Check whether the property falls under A Khata or B Khata.

Incorrect property details can lead to higher taxes, penalties, or legal complications. If discrepancies exist, they should be rectified by submitting the necessary documents to BBMP.

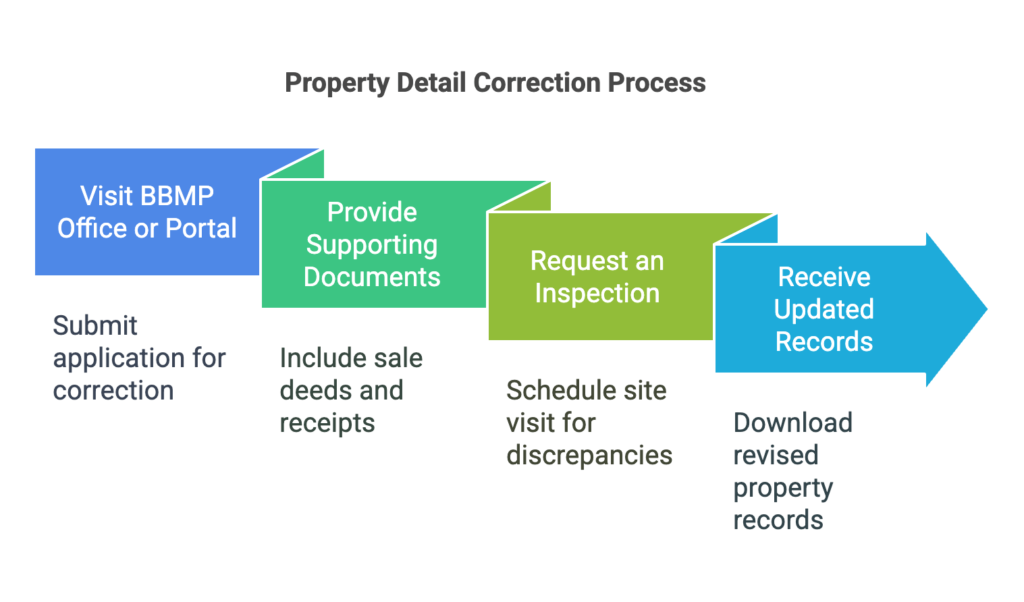

10. How to Rectify Errors in BBMP Property Tax Records

If property owners notice errors in their tax records, they can rectify them by following these steps:

- Visit the BBMP Office or Online Portal – Submit an application for correction, providing valid proof.

- Provide Supporting Documents – This may include sale deeds, property registration documents, approved building plans, and old tax receipts.

- Request an Inspection – In cases of property size discrepancies, BBMP officials may conduct a site visit.

- Receive Updated Records – After verification, BBMP will correct the details, and owners can download the revised records from the portal.

11. BBMP Property Tax for Apartment Owners

Apartment owners in Bengaluru must pay property tax individually for their flats, even though the building might be a single structure. The tax is calculated based on:

- Carpet area of the flat

- Property location and zone classification

- Property usage (residential or commercial)

- Applicable depreciation based on the flat’s age

Apartment associations may also need to pay taxes on common areas such as clubhouses, parking lots, and gardens if they generate revenue from these spaces.

12. Impact of Property Tax on Real Estate Transactions

Property tax payments are a critical aspect of buying or selling real estate in Bengaluru. Buyers should check:

- Whether previous property tax payments are up to date

- If the property has A Khata (as B Khata properties may not qualify for loans)

- Any pending disputes related to tax assessment

Failure to verify property tax payments can result in legal complications and financial liabilities for the new owner.

13. Property Tax for Commercial vs. Residential Properties

BBMP property tax rates differ for commercial and residential properties. Commercial properties generally have:

- Higher per-square-foot taxation rates

- No depreciation benefits (unlike residential properties, where depreciation reduces tax over time)

- Additional cess charges depending on usage

Property owners must declare the correct property usage to avoid penalties and misclassification issues.

14. BBMP Property Tax and Rental Properties

Property tax applies to rental properties, but the liability remains with the owner, not the tenant. However, rental income can influence tax calculations:

- Higher rental yields may lead to higher assessed values in the Unit Area Value (UAV) system.

- Owners renting out residential properties for commercial use must pay commercial property tax rates.

Non-compliance in declaring rental property usage can result in fines or tax reassessments.

15. Understanding the BBMP Property Tax Rebate

BBMP provides incentives for early tax payments, including:

- 5% discount on total tax amount if paid in full before July 31

- Additional rebates for senior citizens, differently-abled individuals, and specific exempted properties

Partial payments do not qualify for rebates, so taxpayers should pay in full to benefit.

16. Common Issues Faced by Property Owners

Despite an online system, property owners may face challenges such as:

- Incorrect tax calculations – Often due to outdated UAV rates or incorrect property categorization.

- Portal downtime – The BBMP website may sometimes experience technical issues.

- Delayed tax receipts – Taxpayers may not immediately receive digital receipts after payment.

For unresolved issues, property owners can visit the nearest BBMP help center or file complaints via the BBMP website.

17. Legal Implications of Non-Payment of BBMP Property Tax

Non-payment or delayed payment of property tax can lead to:

- Late payment penalties of 2% per month on outstanding amounts

- Legal notices and potential seizure of property by BBMP

- Difficulties in obtaining property-related clearances (such as Khata transfer or building permits)

BBMP has taken strict measures against defaulters, including publishing names in newspapers and initiating property attachment proceedings.

18. How BBMP Uses Property Tax Revenue

BBMP allocates property tax revenue to various civic projects, including:

- Road construction and maintenance

- Drainage system improvements

- Waste management and sanitation services

- Public health initiatives

- Parks and community infrastructure development

Ensuring tax compliance directly contributes to the development and maintenance of Bengaluru.

19. Future Changes and Digital Initiatives in BBMP Property Tax

BBMP is continually improving its tax collection process through digital transformation. Plans include:

- Integration with Aadhaar for better record management

- Automated UAV updates to reflect market conditions

- Mobile application for seamless tax payments

- Blockchain-based land record management for transparency

These innovations aim to make tax payments easier and prevent fraud.

20. Final Thoughts on BBMP Property Tax

Understanding and complying with BBMP property tax regulations is essential for property owners in Bengaluru. Timely tax payments not only prevent legal complications but also contribute to the city’s development. By leveraging BBMP’s online tax payment system, property owners can ensure a hassle-free experience while fulfilling their civic responsibilities.

Frequently Asked Questions (FAQs)

How can I pay BBMP Property Tax online?

You can pay BBMP Property Tax online by visiting the official BBMP property tax portal. You’ll need to enter your Property Identification Number (PID) or SAS Application Number to access property details and proceed with the payment.

What does a PID number in BBMP signify?

The Property Identification Number (PID) is a unique number assigned to each property in Bengaluru. It is derived from the ward number, street number, and plot number and is essential for tracking property records and paying taxes.

How do I find my BBMP Property Tax application number?

If your property doesn’t have an assigned application number, you must visit your BBMP ward office and apply for a new property tax registration. Once processed, the BBMP will issue a 10-digit application number for your property.

When is the deadline for BBMP Property Tax payment?

The BBMP Property Tax cycle follows the financial year, beginning on April 1 and ending on March 31 of the following year. Property tax should be paid before March 31 to avoid penalties. If you make a full payment before July 31, you are eligible for a 5% rebate.

What are the consequences of missing the BBMP Property Tax payment deadline?

Failing to pay BBMP Property Tax on time results in a monthly penalty of 2% on the unpaid amount. Persistent non-payment can lead to legal consequences, including property-related restrictions and difficulties in obtaining approvals.

How do I check my BBMP Property Tax payment status?

You can verify the status of your tax payment by visiting here and entering your Application Number or PID Number to track the latest transaction details.

Loved our article? Please visit this page to explore more.