Learn everything about advance tax in India for FY 2024-25, including who pays, how to calculate and due dates.

Table of Contents

Introduction: What is Advance Tax and Why It Matters

Understanding the methods to prevent tax penalties exists without experiencing the pressure of last-minute tax obligations. The freelance graphic designer Mr. Raj discovered his mistake about tax payment the hard way through a costly penalty because he lacked understanding about periodic instead of year-end tax responsibilities. Advance tax operates as a payment method which ensures your taxes maintain synchronization with your earned income throughout the year.

The income tax requirement demands tax payments throughout the financial year as opposed to a single annual conclusion. Advance tax was implemented in India by the Income Tax Act, 1961 to produce regular government revenue streams and protect taxpayers from facing penalties. Throughout FY 2024-25, Union Budget 2025 made this increasingly important by enhancing Section 87A tax rebate which requires essential tax planning for all individuals as well as businesses.

Many people believe that advance tax exists only for wealthy corporations but the truth is different. The requirement to pay advance tax exists for all taxpayers whose annual tax liability exceeds ₹10,000 regardless of whether they are employees or self-employed or run a small business.

Who Needs to Pay Advance Tax?

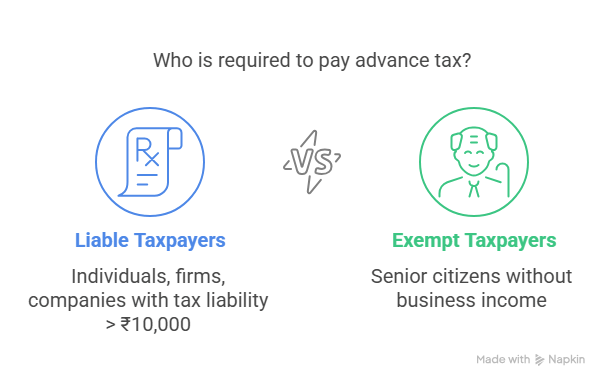

Advance tax applies to anyone whose tax liability for FY 2024-25 exceeds ₹10,000, but the rules vary by taxpayer type. Here’s a breakdown to help you check if you’re liable:

- Any Person with Tax Liability exceeding ₹10,000: Whether you are an individual (resident/non-resident), partnership firm, HUF, company etc., you are required to pay tax in advance i.e. advance tax if your tax liability for the exceeds ₹10,000.

- Exceptions are “Senior Citizens“: If you’re 60 or older and don’t run a business or profession, you’re exempt from advance tax. However, senior citizens with business income or significant investments (e.g., fixed deposits) may still be liable if their tax liability exceeds ₹10,000.

Use this checklist to see if you’re liable:

- Is your tax liability (after TDS and deductions) over ₹10,000?

- Are you a senior citizen without business income? (If yes, you’re likely exempt.)

How to Calculate Advance Tax: Step-by-Step Guide

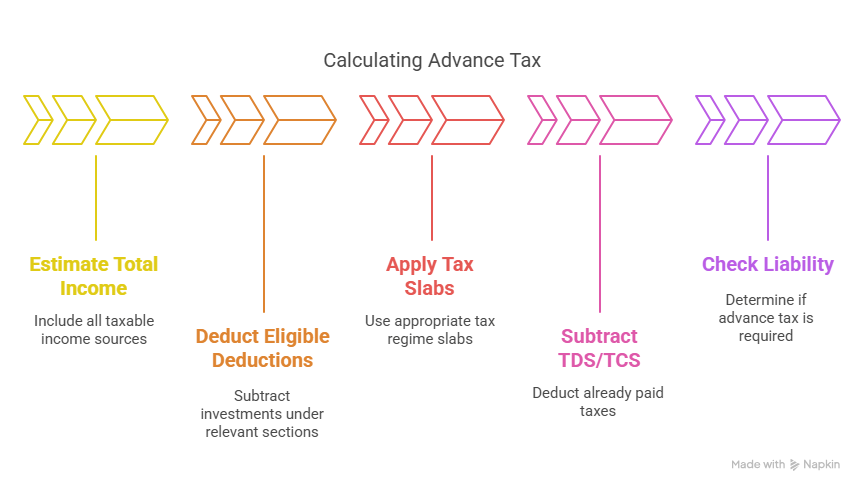

Calculating advance tax can feel daunting, but it’s just a matter of estimating your income and applying the right rates. Here’s a step-by-step guide, with examples for different taxpayers:

- Estimate Total Income: Include all taxable income (salary, business profits, capital gains, rent, interest, etc.) for FY 2024-25.

- Deduct Eligible Deductions: Subtract investments under Section 80C (up to ₹1.5 lakh), 80D (medical insurance), and others depending upon your choice of tax regime (old vs new tax regime).

- Apply Tax Slabs: Use the new or old tax regime slabs for FY 2024-25.

- Subtract TDS/TCS: Deduct any Tax Deducted at Source (TDS) already paid (e.g., on salary, fixed deposits interest).

- Check Liability: If the remaining tax exceeds ₹10,000, you owe advance tax in installments (15%, 45%, 75%, 100% by respective due dates).

Example 1: Salaried Employee with Rental Income

- Income: Salary (₹15 lakh) + Rental income (₹3 lakh) = ₹18 lakh

- Deductions: ₹75,000 (standard deduction on salary) + ₹90,000 (30% standard deduction from Rental Income) = ₹1.65 lakh

- Taxable Income: ₹18 lakh – ₹1.65 lakh = ₹16.35 lakh

- Tax (New Regime): ₹1,87,720 (slab rates+cess)

- TDS: ₹80,000 (on salary)(assumed)

- Advance Tax: ₹1,87,720 – ₹80,000 = ₹1,07,720 (payable in installments)

Example 2: NRI with Property Income

- Income: Rental income from India (₹10 lakh)

- Deductions: 30% standard deduction on rent (₹3 lakh) = ₹7 lakh taxable

- Tax: ₹20,800 (new regime, including cess)

- Advance Tax: ₹20,800 (payable in installments)

Advance Tax Due Dates and Payment Process

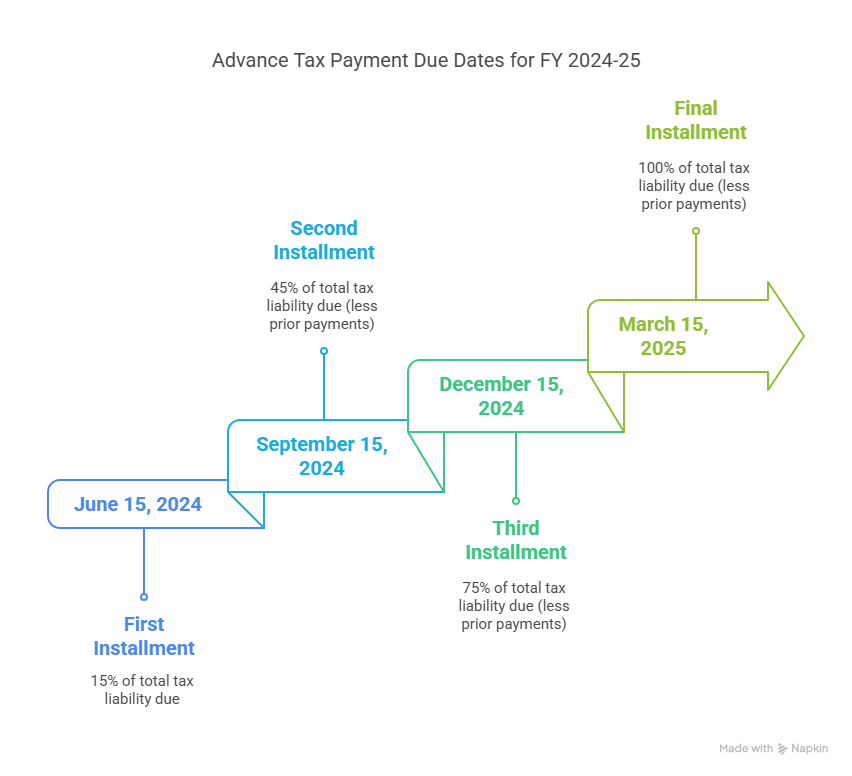

Advance tax is paid in four installments for most taxpayers, except those under presumptive taxation, who pay in single installment by March 15, 2025. Here are the due dates for FY 2024-25:

| Due Date | Cumulative Tax Payable |

|---|---|

| June 15, 2024 | 15% of total tax liability |

| September 15, 2024 | 45% of total tax liability (less) cumulative amount paid earlier |

| December 15, 2024 | 75% of total tax liability (less) cumulative amount paid earlier |

| March 15, 2025 | 100% of total tax liability (less) cumulative amount paid earlier |

Payment Process:

Online: Visit the Income Tax e-filing portal (incometax.gov.in), select “e-Pay Tax,” enter PAN, and choose “Advance Tax (100).” Pay via net banking, UPI, or card. Save the challan receipt.

Common Mistakes and How to Avoid Them

Avoid these shortcomings to stay penalty-free:

| Mistake | Consequence | Solution |

|---|---|---|

| Underestimating income | Interest under Sections 234B/234C (1% per month) | Try to correct estimates and revise quarterly. |

| Missing due dates | Interest | Set calendar reminders. |

| Ignoring TDS/TCS | Overpayment or penalties | Track TDS via Form 26AS/AIS and adjust advance tax. |

| Not filing ITR | Delayed refunds or scrutiny | File by July 31, 2025. |

Want to learn more about Annual Information Statements (AIS), visit our detailed tutorial here.

Frequently Asked Questions (FAQs)

Do I need to pay advance tax if my income is below ₹12 lakh?

It depends upon your final tax liability. Even if your income is below ₹12 lakh, you might have tax liability due to specially taxed incomes. Rebate u/s 87A is not available for tax on such income under new regime. To estimate your tax amount, you can make use of Income Tax Departments official Income Tax Calculator.

Can NRIs skip advance tax?

No, NRIs with Indian income over ₹10,000 tax liability must pay, but Double Taxation Avoidance Agreements (DTAA) can reduce double taxation.

What if I miss a due date?

You are required to pay 1% interest per month under Sections 234B/234C, but you can pay the balance by March 15, 2025.

Is advance tax only for businesses?

No! Individuals, HUFs, and NRIs with high tax liability also pay advance tax.

Conclusion: Take Control of Your Advance Tax Today

Advance tax acts as a stress-management tool to maintain proper tax compliance. Learning about the payment requirements as well as calculation allows you to stay penalty-free while potentially saving money. All taxpayers need to establish proactive strategies considering the advance nature of the amount to be paid. Take action now by estimating your income then checking your payment schedule together with investigating which tax deductions apply to your situation.