Master GST for e-commerce sellers in India with this beginner’s guide! Learn registration, TCS, ITC, e-invoicing, pricing strategies, and avoid common mistakes to grow your online business.

Table of Contents

Introduction to GST and E-commerce Sellers

Have you ever wanted to know how taxes come into play when you sell products online? You might consider opening a business on Amazon by selling handmade jewelry. You are happy with your first sale, but later on, you figure out part of your earnings is taken away as GST. Why is it important, and what is it all about?

In 2017, the Government of India began using GST instead of tax systems like VAT and service tax. GST is the main requirement for e-commerce sellers, whether working on Flipkart, Amazon, or an individual website. Use this blog to learn about GST, so you can be certain your business won’t face legal difficulties when selling products. We’re going to look at GST and e-commerce sellers, from the beginning, as if you have no previous experience.

Why GST Matters for E-commerce Sellers

GST goes beyond being a tax; it is especially important for online businesses. After registering for GST, you get a GSTIN, which confirms that your business exists and can let you trade on Amazon or Flipkart. Through compliance, you can claim Input Tax Credit (ITC) and retain a good reputation with your customers. When businesses do not adhere to the terms, it could result in fines, their games being taken down, or lawsuits. With the e-commerce sellers market in India gaining speed to $200 billion in 2026, getting to know GST will give you the tools to grow in this field.

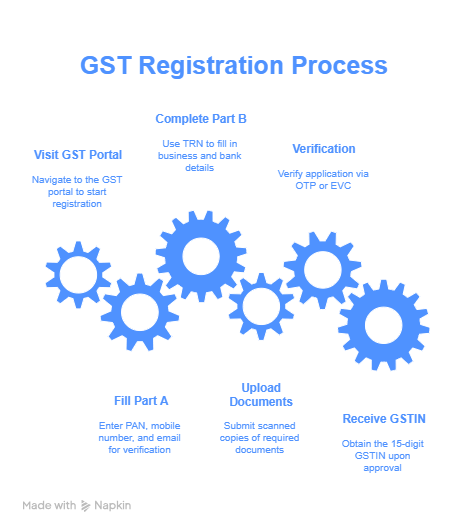

GST Registration: A Step-by-Step Guide

Unlike traditional businesses, e-commerce sellers must register for GST regardless of turnover, except in specific cases (e.g., services under ₹20 lakhs in certain states). Here’s how to register on the GST portal:

- Visit the GST Portal: Go to www.gst.gov.in and click “New Registration.”

- Fill Part A: Enter your PAN, mobile number, and email for OTP verification. Select “Taxpayer” as the type.

- Complete Part B: Use the Temporary Reference Number (TRN) to fill in business details, including:

- Business name and address

- Bank account details

- Proof of business (e.g., shop license, rent agreement)

- PAN and Aadhaar of the owner

- Upload Documents: Submit scanned copies of documents wherever required.

- Verification: Verify via OTP or EVC. The GST officer will process your application within next few working days.

- Receive GSTIN: Once approved, you’ll get a 15-digit GSTIN (e.g., 27ABCDE1234F1Z5).

Understanding TCS and ITC

Tax Collected at Source (TCS) is a tax e-commerce sellers platforms deduct from your sales. For example, if you sell a ₹1000 shirt on Amazon, they deduct 1% (₹10) as TCS and deposit it with the government. You can claim this back when filing GST returns. Input Tax Credit (ITC) helps you reduce your tax liability by claiming GST paid on inputs. Suppose you buy fabric for ₹500 + ₹25 GST (5%). This payment of ₹25 GST to the supplier is called as Input Tax Credit. When you sell the shirt, you charge ₹1000 + ₹50 GST. You pay only ₹15 (₹50 – ₹25 ITC – ₹10 TCS) to the government. You need to keep invoices handy to claim ITC seamlessly.

| Scenario | Sale Price | GST (5%) | TCS (1%) | ITC Claimed | Net GST Paid |

|---|---|---|---|---|---|

| Shirt Sale | ₹1000 | ₹50 | ₹10 | ₹25 (fabric) | ₹15 |

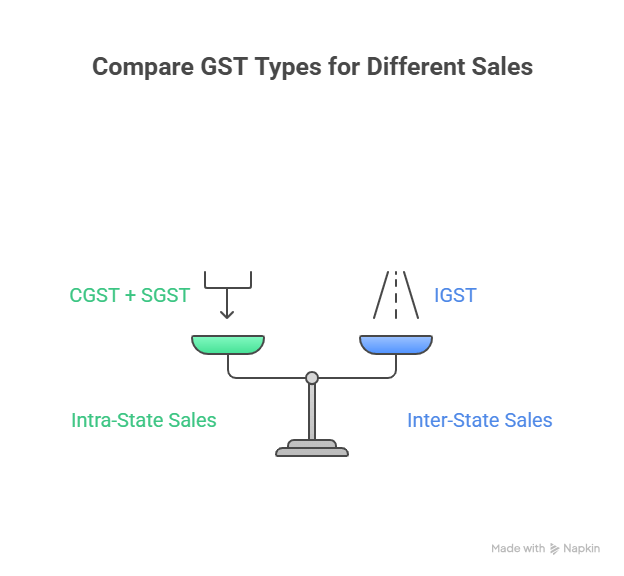

Place of Supply and Tax Types

GST is generally a destination-based tax, meaning it’s applied where the buyer is located. There are three types:

- CGST + SGST: For intra-state sales (e.g., seller and buyer in Maharashtra). Each is half the total GST rate.

- IGST: For inter-state sales (e.g., seller in Gujarat, buyer in Maharashtra).

- Example: You’re in Delhi selling a ₹20000 phone (18% GST) to Mumbai. You charge ₹3600 IGST. If the buyer is in Delhi, you charge ₹1800 CGST + ₹1800 SGST.

For digital services (e.g., eBooks), the place of supply is the buyer’s billing address. Wrongly applying CGST/SGST instead of IGST can lead to refunds and penalties.

| Transaction | Place of Supply | Tax Type | Rate (e.g., 18%) |

|---|---|---|---|

| Delhi to Delhi | Delhi | CGST + SGST | 9% + 9% |

| Delhi to Mumbai | Mumbai | IGST | 18% |

GST Return Filing for Beginners

E-commerce sellers file:

- GSTR-1: Monthly/quarterly details of outward supplies (sales). Due by the 11th of the next month.

- GSTR-3B: Monthly summary of sales, purchases, and taxes. Due by the 20th.

- GSTR-8: Filed by platforms like Amazon for TCS details. Due by the 10th.

The QRMP scheme allows quarterly filing for businesses with turnover below ₹5 crore.

| Return | Frequency | Due Date |

|---|---|---|

| GSTR-1 | Monthly | 11th |

| GSTR-3B | Monthly | 20th |

| GSTR-8 | Monthly | 10th |

Cross-Border E-commerce Sellers and GST

Selling to international customers involves:

- Exports: Zero-rated under GST. You charge no GST but claim ITC on inputs. File a Letter of Undertaking (LUT) to export without paying IGST.

- Imports: Pay IGST on imported goods (e.g., 18% on electronics). Claim ITC if used for business.

- OIDAR Services: Online Information Database Access and Retrieval services (e.g., eBooks, software) are taxable at 18% if supplied to Indian customers, even by foreign sellers.

Example: Selling digital art to a US customer is zero-rated. Selling an eBook to an Indian customer incurs 18% IGST. Consult a CA for cross-border compliance to avoid penalties.

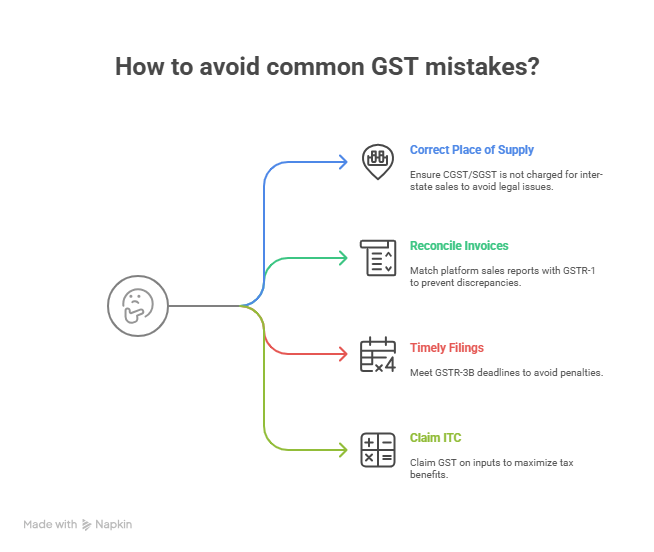

Common Mistakes and How to Avoid Them

New sellers often make these errors:

- Wrong Place of Supply: Charging CGST/SGST for inter-state sales.

- Invoice Mismatches: Sales reported by platforms not matching GSTR-1.

- Late Filings: Missing GSTR-3B deadlines.

- Not Claiming ITC: Forgetting to claim GST on inputs.

Frequently Asked Questions (FAQs)

Do I need to register for GST if I’m a small e-commerce seller with low turnover?

Yes, GST registration is mandatory for all e-commerce sellers in India, regardless of turnover, if you sell through platforms like Amazon or Flipkart.

What is TCS, and how does it affect my e-commerce business?

Tax Collected at Source (TCS) is a tax deducted by e-commerce sellers platforms (e.g., 1% on a ₹1000 sale = ₹10) from your payout and deposited with the government. It impacts your cash flow as you receive less money upfront, but you can claim this TCS as a credit when filing your GST returns (e.g., GSTR-3B).

How do I know whether to charge CGST/SGST or IGST for my sales?

The tax type depends on the place of supply (buyer’s location). For intra-state sales (e.g., seller and buyer in Karnataka), charge CGST + SGST (e.g., 9% + 9% for 18% GST). For inter-state sales (e.g., seller in Karnataka, buyer in Gujarat), charge IGST (e.g., 18%). Verify the buyer’s address before invoicing to avoid errors, which can lead to penalties or refund issues.

What are e-invoicing and e-way bills, and do I need them?

E-invoicing is mandatory for B2B sales if your turnover exceeds ₹5 crore (as of 2025). It involves generating an Invoice Reference Number (IRN) on the GST portal for each invoice. E-way bills are required for interstate goods movement worth over ₹50,000, generated at e-way bill website with invoice and transporter details. Non-compliance can result in penalties or goods seizure, so use automation tools to simplify these processes.

What happens if I make a mistake in GST filing or miss a deadline?

If you make anything from incorrect tax presentation to late filings, the amount you are fined can be as low as ₹200 per day or reach up to 100% of what you ought to pay in case of tax evasion. To prevent this problem, check sales with the platform’s reports, begin using a GST software like ClearTax, and place a reminder in your calendar for each deadline. Should you notice a mistake, ask a CA to make an amendment on your returns.

Conclusion: Thriving with GST

GST may seem daunting, but it’s a gateway to scaling your e-commerce sellers business. By registering, filing returns, and leveraging ITC, you can reduce costs and compete nationally. Avoid common pitfalls with automation tools and stay informed about updates.

Liked our article? Read more about GST on our webpage here!