Learn the basics of Tax Deducted at Source (TDS) in India with this beginner-friendly guide. Understand how TDS works, compliance rules, deduction thresholds, and tips to save taxes efficiently.

Table of Contents

Introduction: What is TDS and Why It Matters

Ever wondered why your salary, rent payment, or freelance income is less than expected? The answer often lies in Tax Deducted at Source (TDS), a system where tax is deducted right when you earn income. Think of TDS as a “prepaid tax”. The government collects a portion of your tax upfront to ensure steady revenue and prevent tax evasion.

TDS affects everyone: Salaried employees; freelancers; landlords; small business owners; and even non-residents earning in India. Compliance alone doesn’t help in understanding TDS. Here, in this guide, we’ll take a look at TDS and explain it in understandable terms, we’ll show you how TDS works in the real world and provide advice on making it beneficial for you. At the end of the article, you will handle TDS like a pro!

Why read on? We’ll cover practical scenarios, legal ways to reduce TDS, and the latest updates – all tailored for beginners.

TDS in Everyday Life: Practical Scenarios

TDS isn’t just a tax term; it’s part of your daily financial life. Let’s explore how it works through relatable stories.

Scenario 1: Priya, the Freelancer

Priya, a graphic designer, creates a logo for a startup and invoices ₹60,000. The startup deducts 10% TDS (₹6,000) under Section 194J (professional fees) and pays her ₹54,000. Priya receives a TDS certificate (Form 16A) and sees the ₹6,000 credited in her Form 26AS. At the time of filing her Income Tax Return (ITR), she claims this ₹6,000 as a tax deduction against her total tax liability, reducing what she owes.

Calculation:

- Invoice: ₹60,000

- TDS (10%): ₹6,000

- Payment received: ₹60,000 – ₹6,000 = ₹54,000

Scenario 2: Raj, the Landlord

Raj rents his apartment for ₹60,000/month. Since the rent exceeds ₹50,000/month, his tenant deducts 5% TDS (₹3,000) under Section 194IB and pays ₹57,000. Raj uses Form 26AS to claim the TDS credit when filing his ITR, potentially getting a refund if his total tax liability is low.

Calculation:

- Monthly rent: ₹60,000

- TDS (5%): ₹3,000

- Payment received: ₹60,000 – ₹3,000 = ₹57,000

Key TDS Rates for Common Payments:

| Payment Type | Section | TDS Rate | Threshold |

|---|---|---|---|

| Salary | 192 | As per slab | Basic exemption limit |

| Professional Fees | 194J | 10% | ₹30,000 |

| Rent (Individuals/HUFs) | 194IB | 5% | ₹50,000/month |

| Contractor Payments | 194C | 1-2% | ₹30,000 (single), ₹1,00,000 (aggregate) |

| Interest on FD | 194A | 10% | ₹40,000 (banks) |

Exemptions and Thresholds: How to Legally Reduce TDS

TDS isn’t always mandatory, and knowing exemptions can save you money. Here’s how to reduce TDS legally.

Common Exemptions

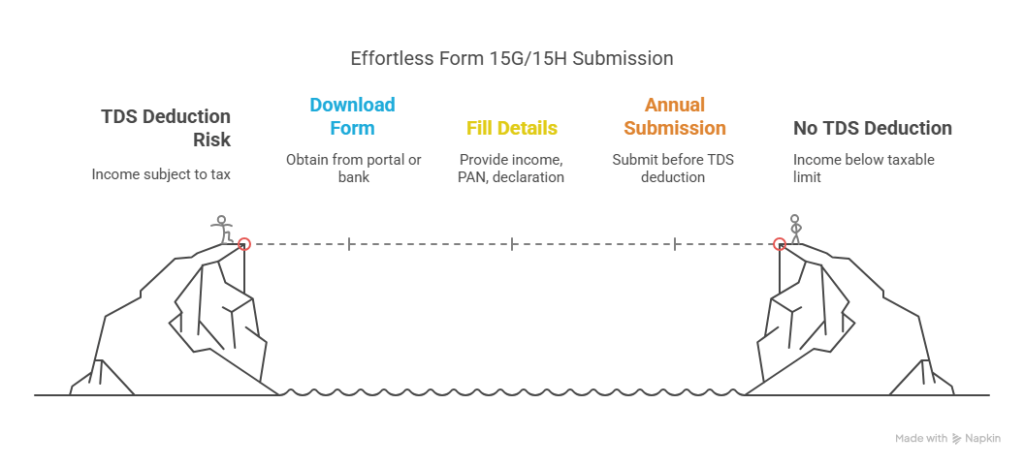

- Form 15G/15H:

- Who can use it? Individuals (Form 15G) or senior citizens (Form 15H) with no expected tax liability.

- What for? Avoid TDS on interest from fixed deposits, savings accounts, or other specified incomes.

- Example: Meera, a retiree, earns ₹2.3 lakh annually, below the taxable limit. She submits Form 15H to her bank, so no TDS is deducted on her FD interest of ₹30,000.

- Threshold Limits:

- TDS applies only above certain limits. For example:

- No TDS on contractor payments below ₹30,000 (single transaction) or ₹1,00,000 (annual aggregate).

- No TDS on rent below ₹50,000/month for individuals/HUFs.

- Example: If Anita pays ₹25,000 to a contractor, no TDS is deducted.

- TDS applies only above certain limits. For example:

- Lower TDS Certificate:

- Apply to the Income Tax Department for a certificate to reduce TDS if your income is below taxable limits.

- Process: Submit Form 13 with income details; the IT Department issues a certificate specifying a lower rate.

How to Apply Form 15G/15H

- Download the form from the Income Tax e-filing portal or your bank’s website.

- Fill in details: name, PAN, income, and declaration of no tax liability.

- Submit to the payer (e.g., bank, tenant) before TDS is deducted.

- Tip: Submit annually, as it’s valid for one financial year.

Checklist for Form 15G/15H Eligibility:

- Resident individual or HUF

- Income below basic exemption limit

- No tax liability for the year

- Not applicable for NRIs

FAQ: Can I avoid TDS on rent? Yes, if your total income is below the taxable limit, submit Form 15G/15H to your tenant.

Consequences of Getting TDS Wrong

Mistakes in TDS can lead to headaches, but they’re fixable. Here’s what happens if you slip up and how to correct it.

Penalties and Risks

- Late Filing Fee (Section 234E): ₹200/day for delayed TDS return filing, up to the TDS amount.

- Example: If Anita delays filing a ₹10,000 TDS return by 30 days, she pays ₹6,000 (30 × ₹200).

- Interest on Non-Payment: 1.5% per month for not depositing TDS on time.

- Example: If Raj fails to deposit ₹3,000 TDS for 2 months, he pays ₹90 interest (₹3,000 × 1.5% × 2).

- Notices and Audits: Incorrect TDS reporting (e.g., mismatched Form 26AS) can trigger IT Department notices or audits.

- Credit Denial: If TDS isn’t deposited or reported correctly, you can’t claim it in your ITR, increasing your tax liability.

Case Study: Resolving a TDS Error

Vikram, a small business owner, forgot to deduct 2% TDS (₹2,000) on a ₹1,00,000 contractor payment. The IT Department sent a notice. He:

- Deposited the TDS with 1.5% monthly interest (₹60 for 2 months).

- Filed a revised TDS return via TRACES.

- Issued a corrected TDS certificate to the contractor.

Result: Penalty avoided, and compliance restored.

What to Do If…:

- You forgot to deduct TDS: Deposit the TDS with interest and file a return.

- Form 26AS doesn’t match TDS certificate: Contact the deductor to revise their TDS return.

- You received a notice: Consult a CA and respond with proof of compliance.

Share your story! Have you faced a TDS issue? Comment below to help others.

Tools and Technology for Easy TDS Compliance

Managing TDS doesn’t require a finance degree, thanks to user-friendly tools. Here’s how to stay on top of TDS.

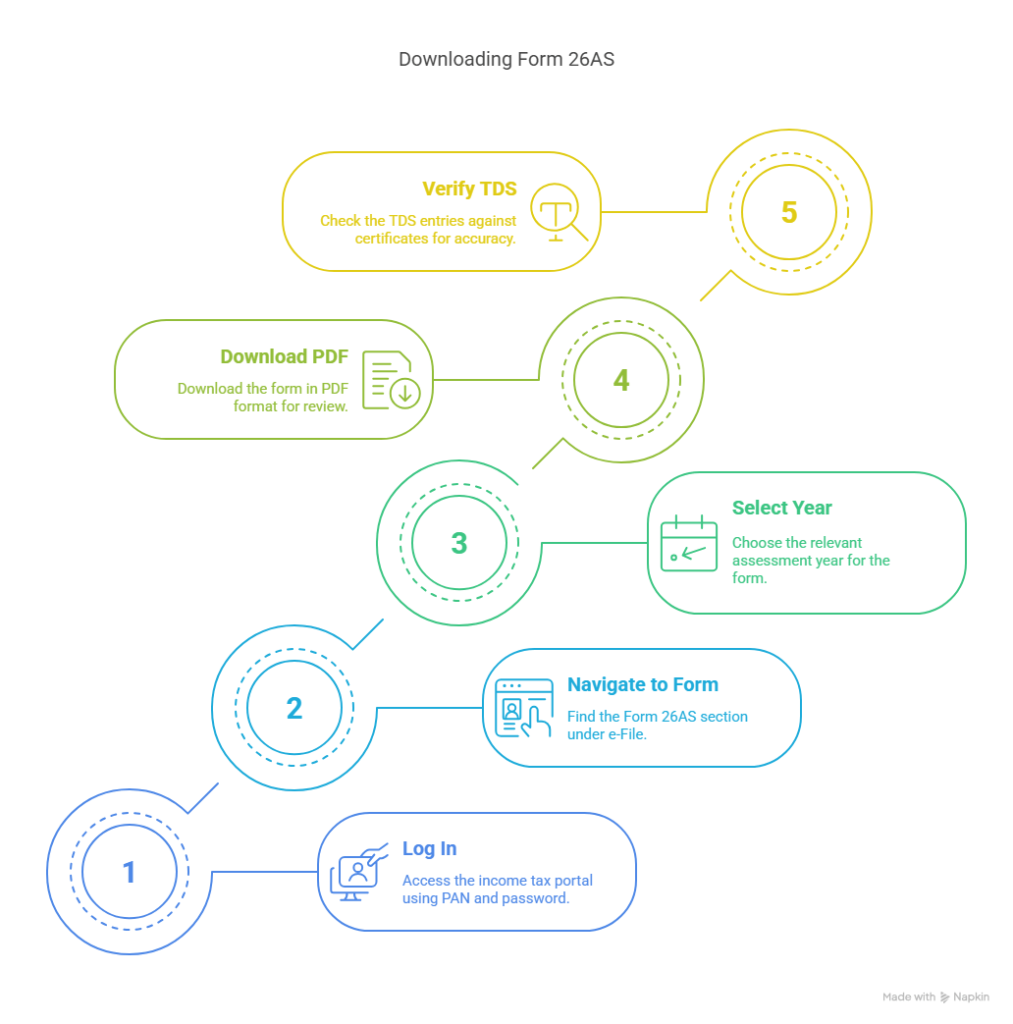

Step-by-Step: Downloading Form 26AS

- Log in to incometax.gov.in with PAN and password.

- Navigate to “e-File” > “Income Tax Returns” > “View Form 26AS.”

- Select the assessment year and download the PDF.

- Check TDS entries against TDS certificates to ensure accuracy.

Analogy: Form 26AS is your TDS dashboard, showing every tax deduction linked to your PAN.

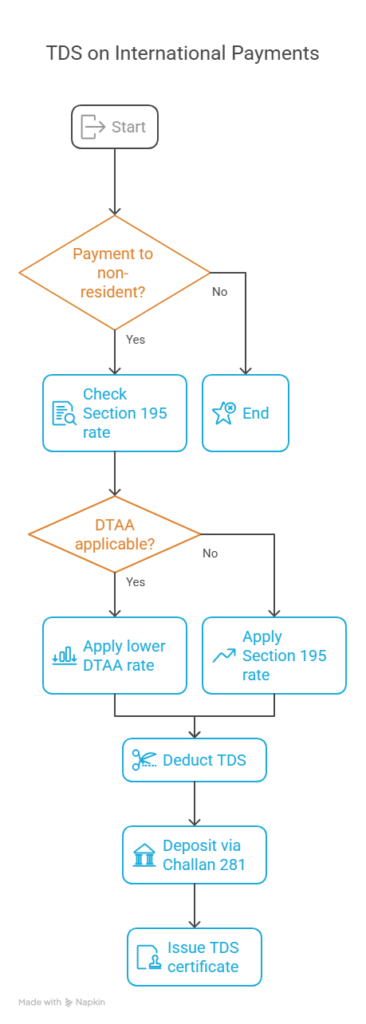

TDS for Non-Residents and International Payments

TDS isn’t just for Indians. If you’re paying a non-resident or receiving income from India, here’s what you need to know.

TDS Under Section 195

- What is it? TDS on payments to non-residents (e.g., royalties, consultancy fees).

- Rate: Varies.

Double Taxation Avoidance Agreements (DTAAs)

- India has DTAAs with 80+ countries to prevent double taxation.

- How it works: If the DTAA rate (e.g., 10% for royalties) is lower than Section 195’s rate, the lower rate applies.

- Process: Submit a Tax Residency Certificate (TRC) and Form 10F to the payer to claim DTAA benefits.

Claiming TDS as a Non-Resident

- Use Form 26AS or TDS certificate to claim credits.

- File an Indian ITR (if required) or apply for a refund via the IT Department.

Flowchart: TDS on International Payments

Resource: Check India’s DTAA list at income tax official website.

Future Trends

- Automation: AI tools will simplify TDS calculations and filings.

- Policy Shifts: Expect tighter TDS rules for digital transactions (e.g., e-commerce, gig economy).

- Global Integration: More DTAAs to ease cross-border taxation.

Frequently Asked Questions (FAQs) About TDS

Got questions about TDS? Here are answers to five common queries to help you navigate this tax with confidence.

How do I know if TDS has been deducted from my income?

Check your Form 26AS on the Income Tax e-filing portal (see above mentioned steps). It lists all TDS deductions linked to your PAN, like salary, rent, or freelance payments. You’ll also receive a TDS certificate (Form 16 for salary, Form 16A for other incomes) from the deductor/payer, showing the amount deducted.

Can I avoid TDS if my income is low?

Yes! If your total income is below the taxable limit, submit Form 15G (individuals) or Form 15H (seniors) to the payer, like your bank or tenant. This prevents TDS on interest, rent, or other incomes.

What happens if I forget to deduct TDS as a business owner?

You’ll face a 1.5% monthly interest on the TDS amount and a potential notice from the Income Tax Department. To fix it, deposit the TDS with interest using Challan 281, file a TDS return, and issue a TDS certificate to the payee.

I’m a non-resident earning from India. How does TDS affect me?

Payments to non-residents (e.g., consultancy fees, rent, etc.) are subject to TDS under Section 195, often at 20% or higher. You can reduce this using a Double Taxation Avoidance Agreement (DTAA) by submitting a Tax Residency Certificate and Form 10F. Claim TDS credits via Form 26AS or an Indian ITR. See “TDS for Non-Residents” for details.

Conclusion: Mastering TDS for Financial Freedom

TDS may seem complex, but it’s a manageable part of your financial journey. By understanding how TDS applies to your income, using exemptions like Form 15G/15H and staying updated on changes, you can save money and avoid penalties. Whether you’re a freelancer, landlord, or business owner, TDS compliance empowers you to focus on growth, not tax stress.

Next Steps:

- Check your Form 26AS for TDS credits.

- Explore exemptions if your income is low.

- Consult a CA for complex cases (e.g., non-resident TDS).

I hope you have gained some basic idea of how TDS mechanism works, for more articles related to Income Tax, visit our dedicated section here.